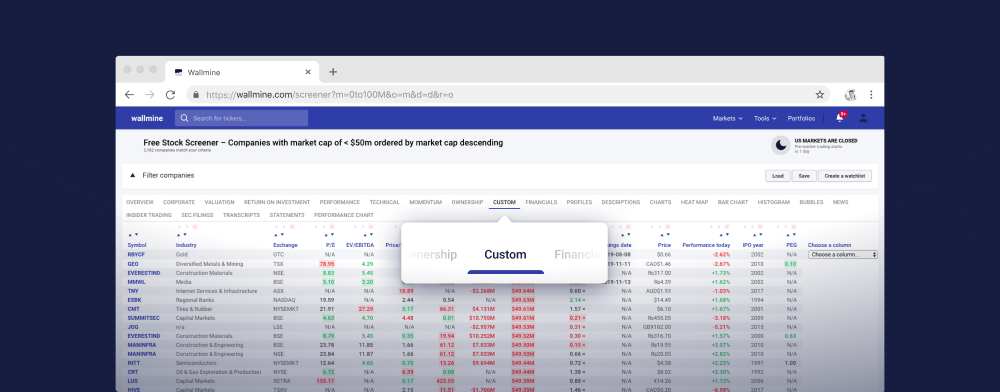

Kostenloser Aktien-Screener

Load Speichern Erstellen Sie eine Watchlist Help

qiwi is a leading provider of next generation payment services in russia and the cis. it has an integrated proprietary network that enables payment services across physical, online and mobile channels. it has deployed over 17.3 million virtual wallets, over 177,000 kiosks and terminals, and enabled merchants to accept over rub 50 billion cash and electronic payments monthly from over 70 million consumers using its network at least once a month. qiwi’s consumers can use cash, stored value and other electronic payment methods to order and pay for goods and services across physical or online environments interchangeably. qiwi – ведущий платежный сервис нового поколения в россии и странах снг, которому принадлежит интегрированная платежная сеть, позволяющая производить платежи по физическим, интернет и мобильным каналам связи. она включает свыше 17,3 млн виртуальных кошельков и более 177 000 терминалов и точек приема платежей. с помощью qiwi торговые компании принимают платежи (в денежной

- QIWI plc, Kennedy Business Centre, Nicosia 1087, Cyprus

- 357 2 2653390

- investor.qiwi.com/investor-relations

- Investor relations

YNDX

Eaton Vance New York Municipal Income Trust is a non-diversified, closed-end management investment company. The Trust's investment objective is to provide current income exempt from regular federal income tax and taxes in its specified state. The Trust invests primarily in debt securities issued by New York municipalities. The Trust invests in various sectors, including cogeneration, electric utilities, escrowed/prerefunded, hospital, housing, industrial development revenue, water and sewer, special tax, real estate, toll road, healthcare-acute, transportation, student loan and senior living/life care. The Trust may invest in residual interest bonds, also referred to as inverse floating rate securities, whereby it may sell a variable or fixed rate bond for cash to a Special-Purpose Vehicle (the SPV), while at the same time, buying a residual interest in the assets and cash flows of the SPV. The Trust's investment advisor is Eaton Vance Management.

- Eaton Vance New York Municipal Income Trust, Two International Place, Boston 02110, United States

- 617-482-8260

- funds.eatonvance.com/new-york-municipal-income-trust-evy.php

- Investor relations

Fiduciary/Claymore Energy Infrastructure Fund is a closed ended equity mutual fund launched and managed by Guggenheim Funds Investment Advisors, LLC.

- Fiduciary/Claymore Energy Infrastructure Fund, 227 West Monroe Street, Chicago 60606, United States

- 312-827-0100

- www.guggenheiminvestments.com/cef/fund/fmo

- Investor relations

RMR Real Estate Income Fund is a closed-end investment fund/investment trust. Its objective is to earn and pay to its common shareholders a high level of current income by investing in real estate companies. The company was founded in 2003 and is headquartered in Newton, MA.

- RMR Real Estate Income Fund, Two Newton Place, Newton 02458, United States

- 617-332-9530

- rmrfunds.com/home/default.aspx

- Investor relations

IMV Inc. operates as a clinical-stage immuno-oncology company. The company develops a portfolio of therapies based on DPX its immune-educating technology platform for treatment of solid and hematological cancers. The company's lead drug candidate includes maveropepimut-S, a DPX-based immunotherapy that targets survivin-expressing cells that is Phase II clinical trials for diffuse large B cell lymphoma; ovarian cancer; and bladder, liver, and microsatellite instability high tumors, as well as in Phase I clinical trial for breast cancer. It also develops DPX-SurMAGE that is in Phase I clinical trial for bladder cancer; and DPX-COVID-19 and DPX-RSV for infectious diseases. The company was formerly known as Immunovaccine Inc. and changed its name to IMV Inc. in May 2018. IMV Inc. was founded in 2000 and is headquartered in Dartmouth, Canada.

- IMV, Inc., 130 Eileen Stubbs Avenue, Dartmouth B3B 2C4, Canada

- 902 492 1819

- imv-inc.com

- Investor relations

Silver Bear Resources Plc engages in the acquisition, exploration, evaluation, and development of precious metal properties in Russia. The company explores for gold, silver, copper, lead, and zinc deposits. Its principal asset is the Mangazeisky silver project covering a license area of approximately 570 square kilometers located to the north of Yakutsk in the Republic of Sakha. Silver Bear Resources Plc was incorporated in 2017 and is headquartered in London, the United Kingdom.

- Silver Bear Resources Plc, Regis House, London EC4R 9AN, United Kingdom

- 416-847-7305

- silverbearresources.com

- Investor relations

Axion Ventures Inc., an investment issuer, primarily focuses on investments in the online video gaming and other information technology sectors in China and internationally. It is involved in the game software development, game operation, provision of outsourcing services, software licensing, and software training businesses. The company was formerly known as Capstream Ventures Inc. and changed its name to Axion Ventures Inc. in March 2017. Axion Ventures Inc. was incorporated in 2011 and is headquartered in Vancouver, Canada.

- Axion Ventures, Inc., 595 Burrard Street, Vancouver V7X 1S8, Canada

- 604-219-2140

- axionventures.com

- Investor relations